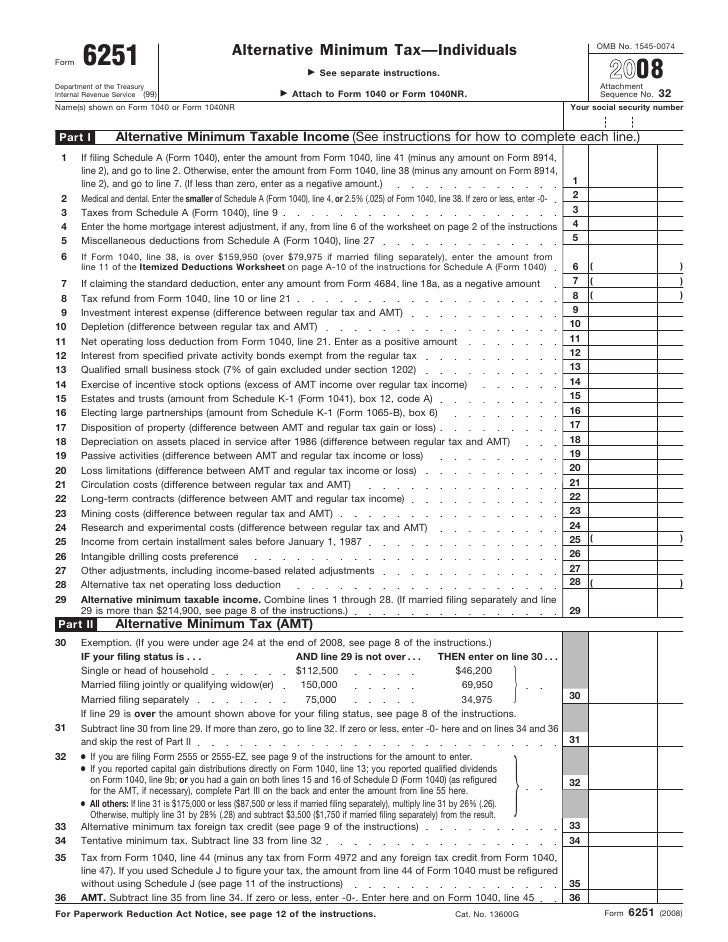

This ruling may affect the amount some taxpayers report as a home mortgage interest adjustment on Form 6251 Alternative Minimum Tax-IndividualsThe instructions for Form 6251 include a worksheet. The worksheet in the TaxAct program titled Form 6251 - Home Mortgage Interest Adjustment Worksheet - Line 4 calculates the amount to transfer to Line 4 of IRS Form 6251 Alternative Minimum Tax - Individuals as an adjustment to the AMT tax calculated.

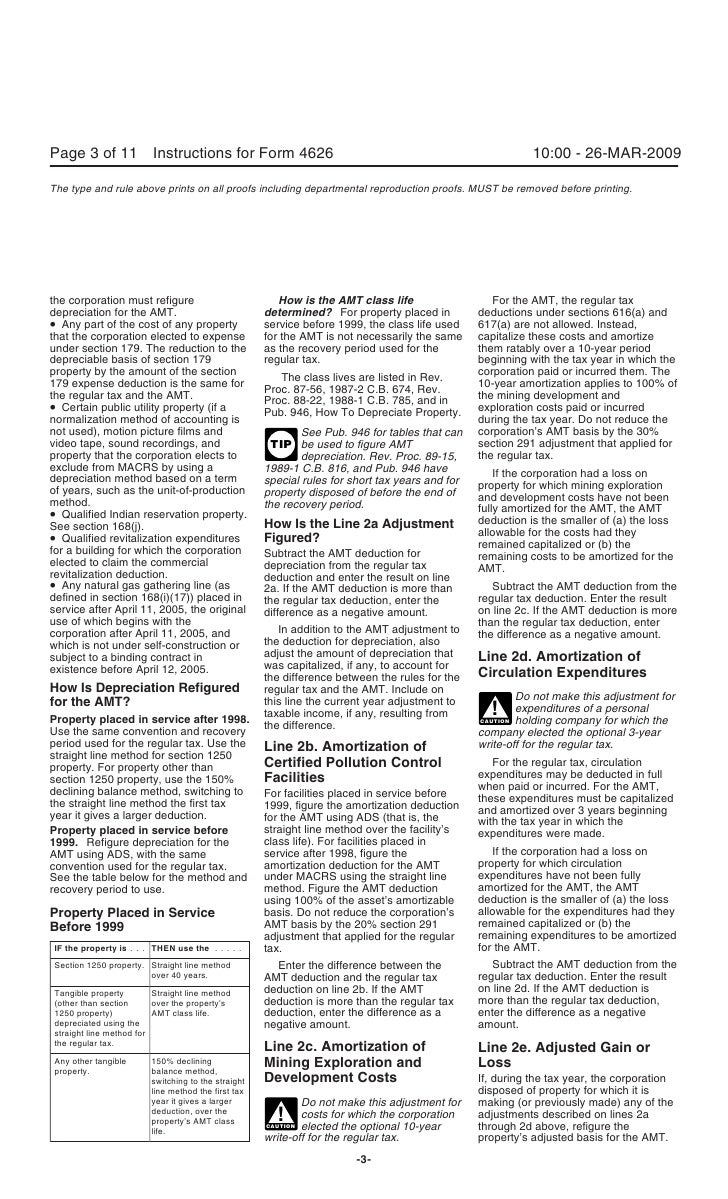

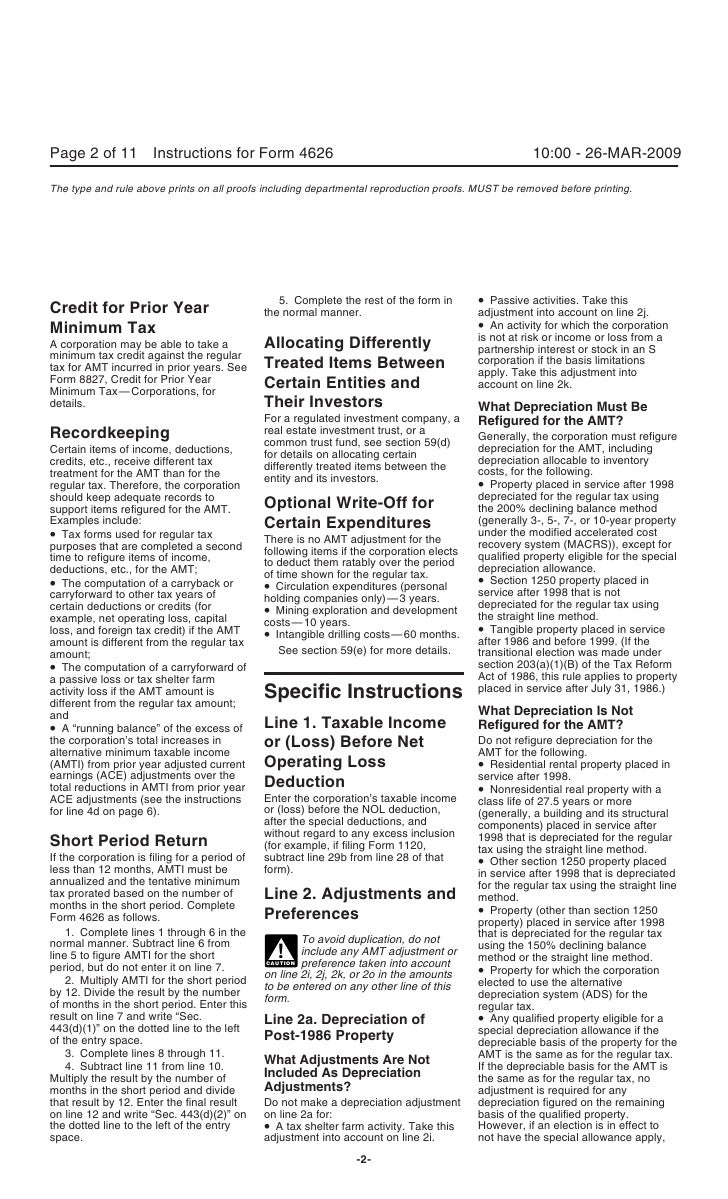

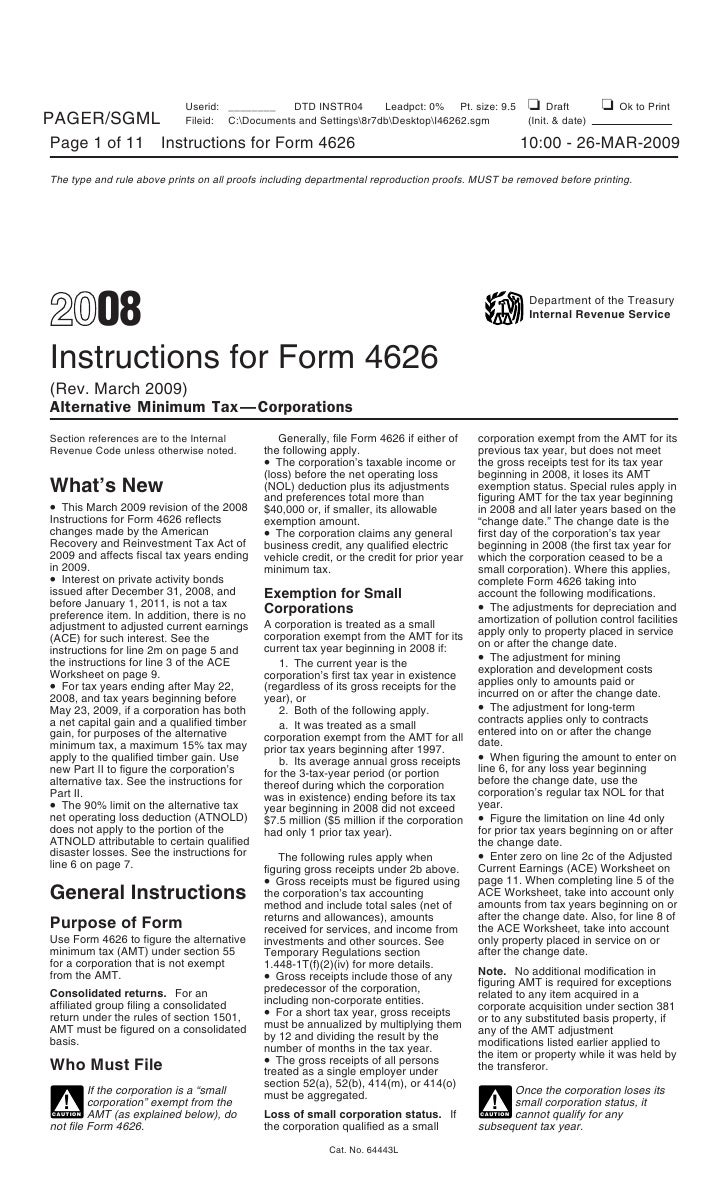

Form 4626 Alternative Minimum Tax Corporations

The worksheet in the TaxAct program titled Form 6251 - Home Mortgage Interest Adjustment Worksheet - Line 4 calculates the amount to transfer to Line 4 of IRS Form 6251 Alternative Minimum Tax - Individuals as an adjustment to the AMT tax calculated.

Amt home mortgage interest adjustment worksheet. Open your clients Form 1040 return. For the regular tax individual taxpayers can deduct mortgage interest that is qualified residence interest QRI. Interest Line 4 Enter the home mortgage interest adjustment if any from line 6 of the worksheet on page 2 of the instructions 56e.

Enter the total of the home mortgage interest you deducted on lines 10 producer or royalty owner. In 2018 this is also the. Follow the Form 4952 instructions for line 1 but when completing line 1 also include any interest that would have been deductible if tax-exempt interest on private activity bonds were includible in gross income.

If you end up taking the Standard Deduction the interest wont be used for the Federal return. QRI is interest on. Mortgage interest years before 2018 and after 2025.

Line 4Home Mortgage Interest Adjustment Complete the Home Mortgage Interest Adjustment Worksheet to figure the amount to enter on this line. However on the Deductible Home Mortgage Interest Worksheet TurboTax adds the full amount of all 3 loans together even though 2 of them have been paid off to calculate the average balance of all home acquisition debt part 2 line 2 so my debt appears 3 x larger than it. Home Mortgage Interest Adjustment WorksheetLine 4 other natural deposits under section 611 Keep for Your Records is limited to the propertys adjusted basis at the end of the year as refigured for the AMT unless you are an independent 1.

To view the worksheet in TaxAct Online. They paid 5000 in interest on the home equity loan in 2014. For purposes of calculating the AMT home mortgage interest adjustment any interest amounts entered in the Home Mortgage Interest Limitation section in the MortgInt screen that are omitted from this section will be treated as eligible mortgage interest to the extent the deduction for mortgage interest is allowed.

If a taxpayer can deduct more mortgage interest for regular tax than for AMT the difference is an adjustment that the taxpayer adds back in calculating AMTI. Enter your AMT disallowed investment interest expense from 2019 on line 2. Click Tools on the right side of the screen to expand the.

Mortgage or home equity loan interest to the extent the loan proceeds are used to purchase construct or improve a principal residence. How to complete the buy build or improve amt for the home mortgage interest worksheet. See the corresponding lines.

The definitions of certain terms used in the worksheet are as follows. Year however no AMT adjustment is needed since. This was a change from the Tax Cuts and Jobs Act.

I refinanced once - and my mortgage was also sold from one bank to another in 2019 - so I received 3 1098 Forms. To access the Deductible Home Mortgage Interest Worksheet in ProSeries. For a taxpayer with a vacation home who is subject to AMT a larger allocation of property tax to the rental activity may be beneficial.

Complete the Home Mortgage Interest Adjustment Worksheet provided in the 2017 federal form 6251 instructions the amount of your using Iowa home mortgage interest deduction entered on the IA 1040 Schedule A. Sign in to your TaxAct Online return. This information is needed now to calculate the amount of Home Mortgage Interest you can claim.

Concerning the alternative minimum tax AMT contains a definition of AMT-deductible qualified housing interest21 There it is defined as qualified residence interest both indebtedness that is incurred in acquiring property22 Thus IRS reasoned if. Field enter D H and M to find Ded Home Mort in the form menu. If the mortgage interest.

They enter the following amounts on the Home Mortgage Interest Adjustment Worksheet. Lines 7 through 21. As clarified by Revenue Ruling 2005-11 a taxpayer should include in the worksheet calculation as interest paid on a mortgage whose proceeds were used to refinance an eligible mortgage qualified housing interest on a.

Double-click Ded Home Mort or select OK. To view the worksheet in TaxAct Online. Click the Forms link on the right side of the screen.

The instructions for Form 6251 include a worksheet to help taxpayers determine the correct home mortgage interest adjustment. 24000 on line 1 10000 plus 9000 plus 5000 10000 on line 2 9000 on line 3 -0- on line 4 19000 on line 5 10000 plus 9000 and 5000 on line 6 24000 minus 19000. Sign in to your TaxAct Online return.

Tap the F6 key to go to the Open Forms window. An eligible mortgage is a mortgage whose proceeds were used to buy build or substantially improve your main home. Include a worksheet that may help you determine whether.

/ScreenShot2021-02-11at1.37.43PM-974cede3b55f40428918bba4eb8d695b.png)

Form 6251 Alternative Minimum Tax Individuals Definition

Https Resources Taxschool Illinois Edu Taxbookarchive 2011 2011 2006 20amt Pdf

Https Www Irs Gov Pub Irs Prior I6251 2001 Pdf

Simple Bill Tracker Budgeting Bill Organization Budgeting Finances

Https Www Irs Gov Pub Irs News Fs 08 01 Pdf

2015 Alternative Minimum Tax Presented By Jaimee Hammer Ea Ppt Download

Form 4626 Alternative Minimum Tax Corporations

Your 2019 Guide To The Alternative Minimum Tax The Motley Fool

Alternative Minimum Tax Amt The H Group Portland Oregon

The Alternative Minimum Tax Not Just For The Wealthy Lfc

Https Resources Taxschool Illinois Edu Taxbookarchive 2011 2011 2006 20amt Pdf

Https Www Irs Gov Pub Irs Prior I6251 2018 Pdf

Verification Of Employment Form Google Search Employment Letter Sample Letter Template Word Confirmation Letter

Tax Deductions For Home Mortgage Interest Under Tcja

Pin On New Updated Look Budget Forms More

Form 4626 Alternative Minimum Tax Corporations

2 3 11 Command Codes Txmod And Sumry Internal Revenue Service

:max_bytes(150000):strip_icc()/taxform-ecf039afd76243459ca7bd90fe007293.jpg)

0 comments:

Post a Comment